After tax profit margin formula

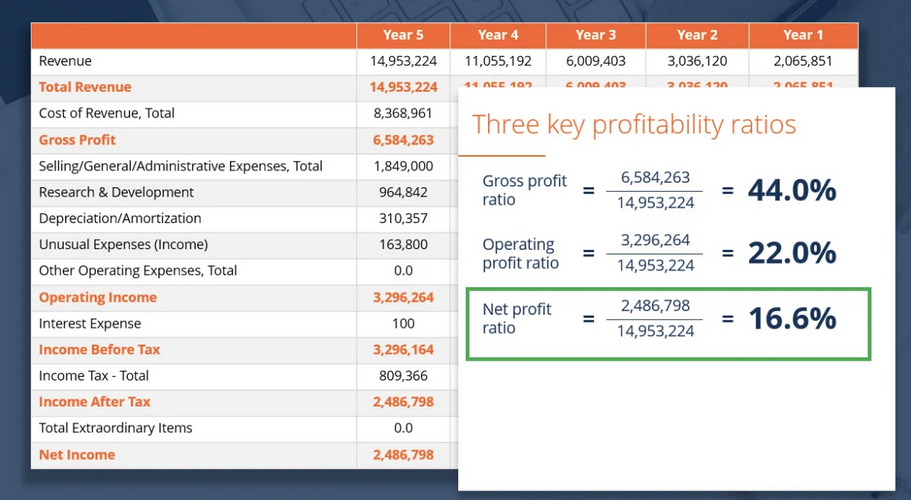

It more directly identifies the funds left. The gross profit margin helps in measuring a companys efficiency in production over a period of time.

Net Profit Margin Formula And Calculation Wise Formerly Transferwise

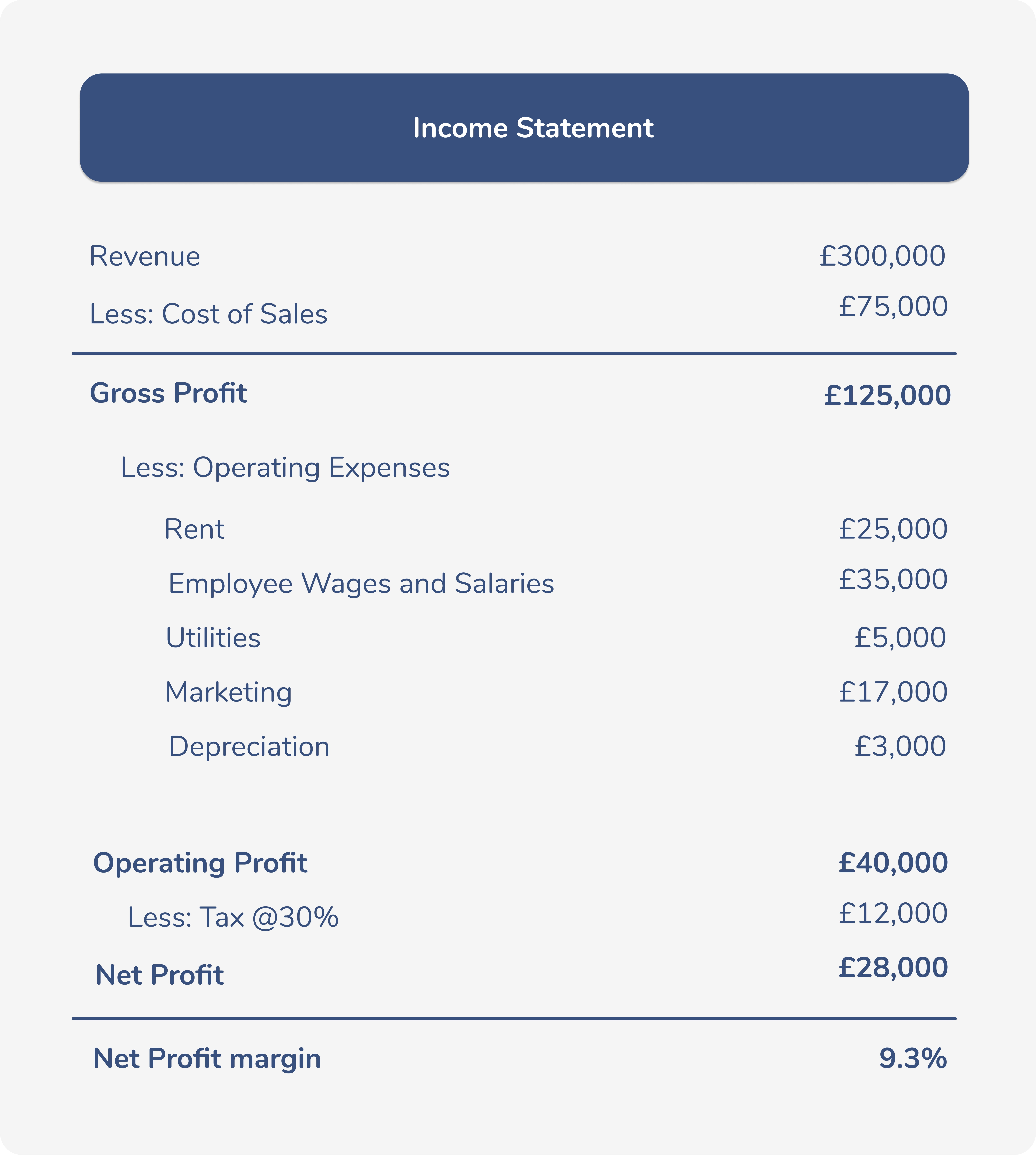

However the net profit margin is not merely the amount of cash left in the company after all of the costs eg salaries utilities or depreciation are covered.

. Gross profit margins are always displayed as a percentage figure never whole numbers. Use the gross profit formula to find out the total gross profit ie Gross Profit Revenue - Cost of goods sold. A Markup expressed as a percentage of cost price.

Hence sales value should be net of any taxes. ABC Ecommerces Profit Margin 250000800000 x 100 3125. Operating Profit Margin formula.

Gross profit margin gross profit. Let us understand the Operating margin with a hypothetical example. The Midrange is being computed as the average of the maximum and the minimum values present in the data sample corresponds to the measure of central tendency.

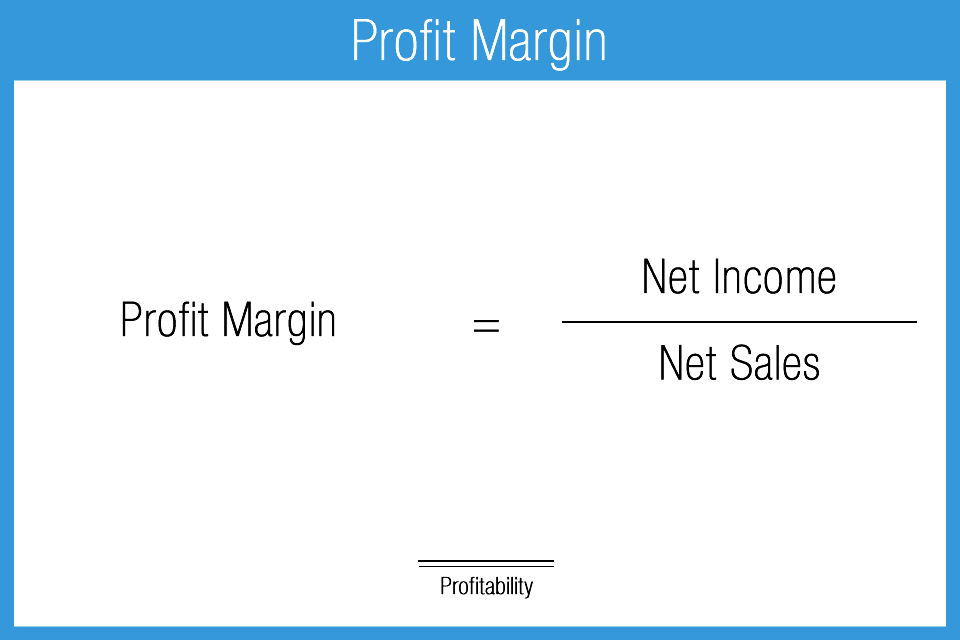

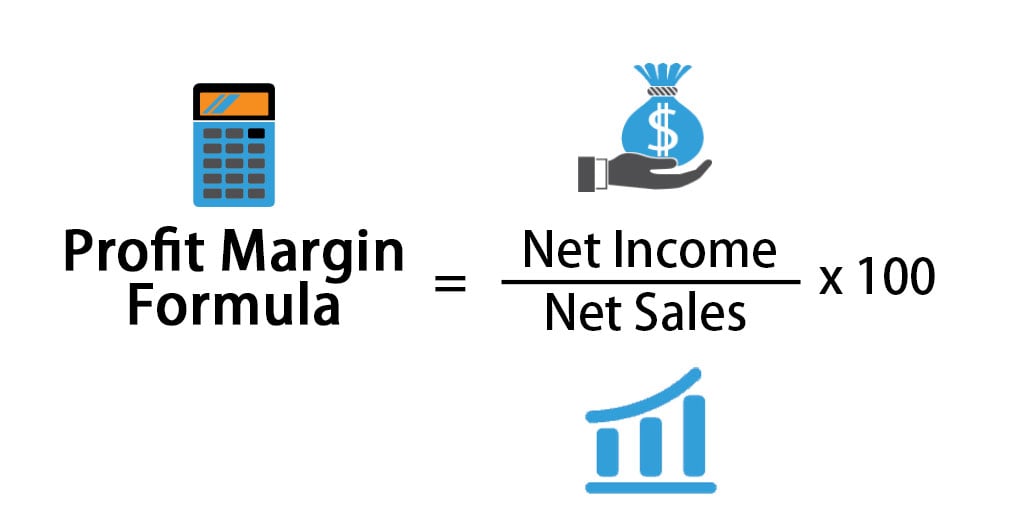

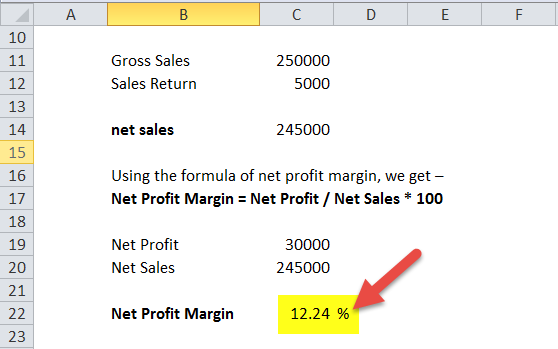

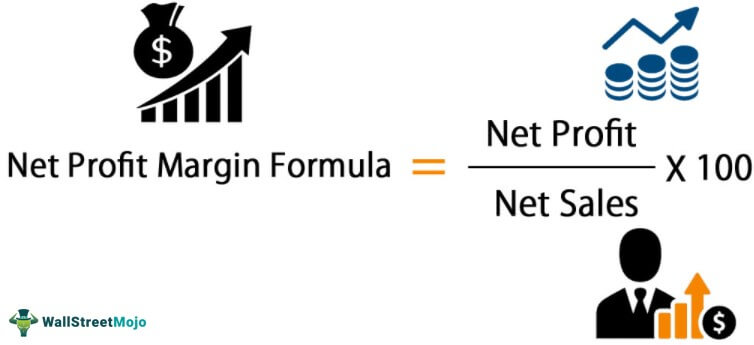

There may be tax implications to consider from your decision. Net profits Net sales x 100 Net profit margin. The net sales part of the equation is gross sales minus all sales deductions such as sales allowances.

Midrange 87 2. To calculate your profit margin you first need to calculate your net income and net sales. Talk to your accountant or business adviser for more advice.

Net Profit Margin 075. 401k After-tax cost of debt Altman Z-Score. Gross profit margin Gross profit Total revenue 100.

Profit Before Tax Definition. The net profit margin formula may approximate the efficiency of this process. The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100.

The profit margin essentially tells you the same thing as the calculations above but the percentage is useful when comparing your performance to other businesses. The formula for Operating Profit Margin is similar to other profitability ratios. The net profit margin is calculated as-Net Profit Margin Net Income Net Revenue.

Gross margin is a companys total sales revenue minus its cost of goods sold COGS divided by total sales revenue expressed as a percentage. Heres how to calculate ABC Ecommerces profit margin. To show your gross profit figure as a profit margin calculate.

Profit percentage is of two types. The profit margin formula will then calculate a selling price for you. The formula for Midrange basically the average of the data set.

Profit before tax PBT is a line item in a companys income statement that measures profits earned after accounting for operating expenses like COGS SGA Depreciation Amortization etc non-operating expenses Non-operating Expenses Non operating expenses are those payments which have no relation with the principal business. Sales value should not include any tax amount collected from customers. Once youve identified your net income and net sales you can use the profit margin formula.

The gross margin represents the percent of total. Profit margin can also be calculated on an after-tax basis but before any debt payments are made. So the net profit margin of the company is.

The difference between gross profit margin and operating profit margin is that the gross profit margin includes direct production costs only materials labour involved directly in production whereas operating profit margin takes into. Midrange 54 33 2. Lets take an example to calculate the net profit margin.

Net profit margin is the percentage of revenue left after all expenses have been deducted from sales. This is referred to as an after-tax unadjusted margin. Gross Profit Margin Formula.

But before interest and tax. The gross profit margin is the gross profit over the revenue. How to calculate profit margin.

Midrange 435 Explanation. Net Profit Margin 45000 60000. You can use these calculations to work out your gross profit margin and your net profit margin as a percentage.

The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service. Suppose a company has a net income of 45000 and net revenue of 60000 in the year 2018. Expenses in order to minimize the amount of tax liability that.

B Profit margin which is the percentage calculated using the selling. The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses and is expressed as a percentage of cost price or selling price. Revenues in turn are converted into income.

Net Profit Margin Formula And Ratio Calculator

Net Profit Margin Accounting Play

Profit Margin Formula Calculator Examples With Excel Template

Guide To Profit Margin How To Calculate Profit Margins With Examples

Profit Margin Formula And Ratio Calculator

Net Profit Margin Prepnuggets

Pretax Profit Margin Formula Meaning Example And Interpretation

What Is Net Profit Ratio Accounting Capital

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Net Profit Ratio Double Entry Bookkeeping

Operating Profit Margin Formula Calculator Excel Template

Net Profit Business Tutor2u

Net Profit Margin Definition Formula How To Calculate

Profit Percentage Formula Examples With Excel Template

After Tax Profit Margin Definition And Meaning Market Business News

Net Profit Margin Formula And Ratio Calculator

Net Profit Margin Definition Formula How To Calculate